Uganda lender UDB allowed to retain 2018 profits

UDB Chief Patricia Ojangole during a previous function

UDB Chief Patricia Ojangole during a previous function

The finance ministry has allowed patient lender Uganda Development Bank UDB, to plough the UGX 9.49bn net profit for 2018 back into the pool of money that will be available for lending.

Speaking during the lenders results announcement this week, finance minister Matiya Kasaija said he has signed off an instrument that will allow the bank to retain the profits instead of transferring the same to the consolidated fund.

He however said the bank should set up a monitoring department to liaise with borrowers to facilitate early detection of non-performance.

The UGX 9.49bn represented a 14pc surge in net profit over the UGX 8.31bn achieved in 2017. The result came off a loan book that expanded from UGX 242.66bn in 2017 to UGX309.62bn in 2018.

The lender received a $20 million capital injection during 2018, boosting its tradable assets.

Chief executive Patricia Ojangole said lending to agriculture and other productive sectors had generated 54,000 new jobs during the year while enterprises supported by the bank remitted UGX 110,26bn in tax revenue.

“Many of the clients we finance are farmers and this creates many direct jobs,” she said.

Until Kasaija directive which is aimed to boost the revamped lenders capital, any profit earned would be destined for the non-tax revenue basket under the consolidated fund. Presidnet Museveni wants UDB’s coffers shored up with additional funds to expand the pool of affordable credit to business to counter commercial lending primes that are still stuck in the lower 20’s band.

Shell Club rewards first winners with brand new motorbikes in Mbale

Shell Club rewards first winners with brand new motorbikes in Mbale

CSBAG roots for increased funding for renewable energy

CSBAG roots for increased funding for renewable energy

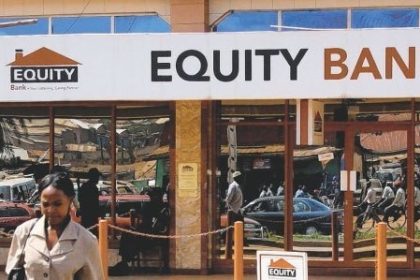

Equity walks tried and tested path to deliver solid half-year

Equity walks tried and tested path to deliver solid half-year

Nile Breweries primes retailers for brave new world

Nile Breweries primes retailers for brave new world

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet