Stanbic dangles tempting carrots to point savers to new credit facilities

Ugandan lender Stanbic has launched what it has dubbed as the Unbeatable Loans campaign that is intended t0 draw attention to its financing solutions portfolio.

The campaign that runs between February 10 and May 31, 2020l 31st May 2020, showcases the lender’s range of loan products ranging from personal loans, to home loans and instant overdrafts at what are believed to be the lowest rates in the market. Israel Arinaitwe, Stanbic’s head of Personal Markets says extending short and long term credit to individuals and businesses is important for the economy because it supports growth in output.

“Quick and affordable financing is an essential stimulus to the continued growth of Uganda’s economy. As the leading bank in the country, we try to support growth of clients’ activities and businesses by providing financial solutions that meet their needs,” said Israel Arinaitwe, Stanbic Uganda’s Head of Personal Markets.

Israel explains that the Unbeatable Loans campaign aims to create awareness about the different lending solutions available that are tailored to suit the unique needs of individual customers at the lowest interest rate in the market. The loans are also fast-tracked and disbursed in real time.

“We have improved our processes and introduced technology to provide financing much faster and more efficiently. For example, customer can access the cash advance in real time using their phone. They can also seamlessly top up their unsecured salary loans using our internet banking platform,” he added.

According to the BoU’s monetary policy report for December 2019, there was a decline in private sector credit growth during 2019 Q4 due to a slowdown in economic activity. Year-on-year growth in private sector credit averaged 12.6opc in the three months to October 2019, lower than the 14.3pc recorded in the three months to July. Empirical evidence suggests that financial institutions can jump-start growth by lending more in such times.

The report further reveals that average annual credit growth attributable to the personal and household loans sector was 7.9pc in the quarter to October 2019, lower than 8.7pc in the preceding quarter. In the same period, average annual credit growth in the Manufacturing sector was 14.4pc, down from 21.2pc. Lending to trade fell to 11.9pc from 14.8pc while building, mortgage, construction and real estate marginally fell to 12.8pc from 12.9pc. The outlayer was the agriculture sector, whose annual average credit growth was 23.7pc against 18.8pc in the comparable period. Lending to agriculture was bolstered by the Agricultural Credit Facility’.

Standard Bank Group appoints new Chief Executive for Uganda Holdings

Standard Bank Group appoints new Chief Executive for Uganda Holdings

TradeMark Africa introduces new App to limit EAC trade barriers

TradeMark Africa introduces new App to limit EAC trade barriers

Employer hiring up during November as Stanbic PMI rises to 53.4

Employer hiring up during November as Stanbic PMI rises to 53.4

Shell Club rewards first winners with brand new motorbikes in Mbale

Shell Club rewards first winners with brand new motorbikes in Mbale

CSBAG roots for increased funding for renewable energy

CSBAG roots for increased funding for renewable energy

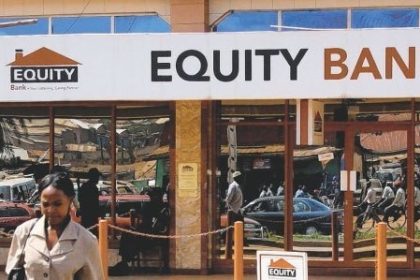

Equity walks tried and tested path to deliver solid half-year

Equity walks tried and tested path to deliver solid half-year