Kenyan fintechs take bulk of $1 billion invested in African start-ups

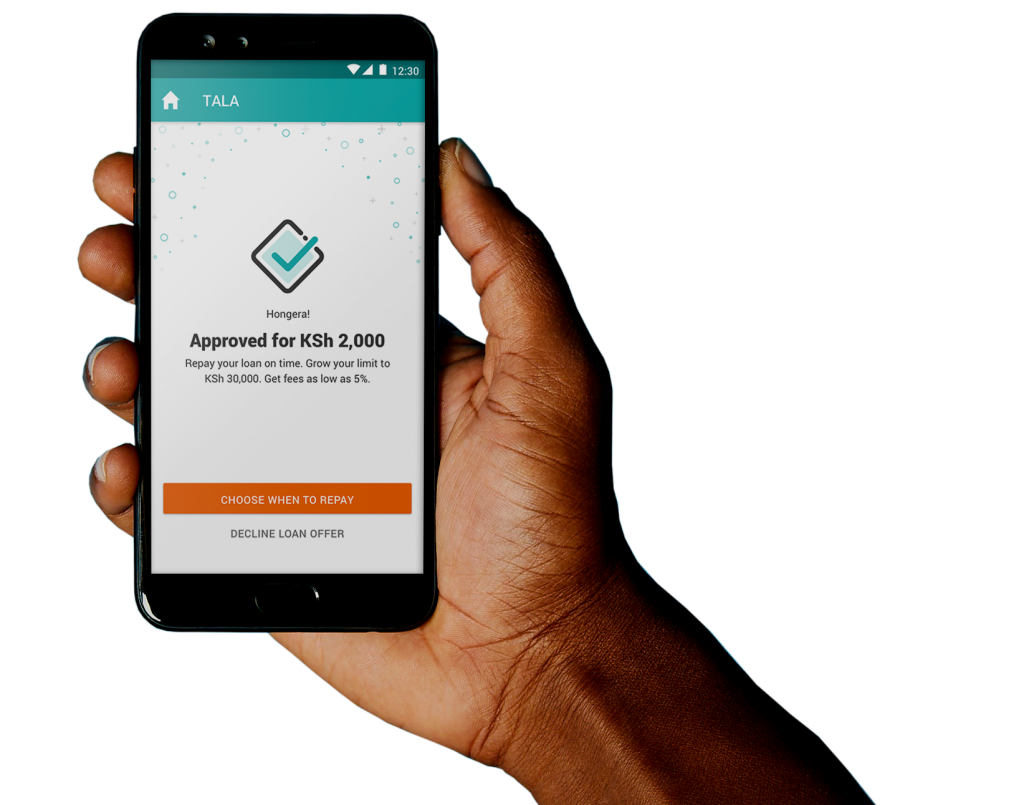

Tala, Cellulant and Dlight led the Kenyan success stories attracting investments of $50 million; $47.5 million and $41 million respectively.

Tala, Cellulant and Dlight led the Kenyan success stories attracting investments of $50 million; $47.5 million and $41 million respectively.

April 24–Kenyans took the lion’s share of the over $1 billion that went into African start-ups during 2018, with much of this money going into fintech ventures aimed at increasing financial inclusion.

In its annual report published at the end of March, Partech, the US-based investment firm, says Kenyans received $348 million of total $1.163 billion investors injected into African start-ups. This is double the $560 million in 2017.

Driven by Fintech, financial inclusion remains the main investment sector on the continent, attracting 50 pc of the total funding last year.

However there has also been a shift. Some 30 pc of the 2018 funding, (compared to 13 pc in 2017), went to business-to-business (B2B) ventures while Consumer Services accounted for 19.6 pc. Last year the figure was 42 pc.

Tala, Cellulant and Dlight led the Kenyan success stories attracting investments of $50 million; $47.5 million and $41 million respectively.

Nigerians came in second across Africa at $306 million and South Africans third with$250 million. Within the region Tanzanian start-ups got $75 million, Rwandans got $19 million, the Ethiopians $11 million while Ugandans received only $2 million.

But Zianah Muddu, the Engagement Partner for the Financial Technology Service Providers Association of Uganda (FITSPA) said, “Local fintechs are actively looking for investment and partnerships. As an association, our goal is to position our members for global recognition and encourage them to a be competitive. This year Uganda will be hosting the Africa Fintech Festival 2019 to enable us showcase our fintechs and innovations to the rest of the world. ” She is also the Executive Secretary of the Africa Fintech Network.

According to Cyril Collon and Tidjane Dème, General Partners from the Partech Africa Fund, the numbers confirm the attractiveness of African entrepreneurs and their ability to transform the continent into a global powerhouse

Collon said, “Twenty eighteen (2018) saw another record year for the African venture capital market. It’s quite simply astonishing. When we started our journey to create the Partech Africa Fund in 2015, we had anticipated the $1 billion mark to be broken by 2020. We are now already two years ahead of our projections.”

However the authors clarify that the numbers cover African start-ups that we define as companies with their primary market being in Africa itself (i.e. in terms of operations and revenues). In other words, what we call an African start-up is not based on the headquarters location or the country of incorporation.

A number of private equity investors (TPG, Helios, Goldman Sachs, Carlyle and so on) as well as major corporate players like Naspers, Paypal, Pernod and Ricard, are now joining the game earlier, investing early in African tech start-ups.

Kenya, Nigeria and South Africa are still leading the race, absorbing 78 pc of the total funding, similar to last year but with Egypt closing-up.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

Unpacking results-based financing: balancing strengths with weaknesses

Unpacking results-based financing: balancing strengths with weaknesses

Women social entrepreneurs offered chance to visit New York

Women social entrepreneurs offered chance to visit New York

Why and how economics must change

Why and how economics must change

Stanbic Bank Uganda Chief Executive elevated to regional role in Nairobi

Stanbic Bank Uganda Chief Executive elevated to regional role in Nairobi