Trading leads as main source of income for Ugandans

Trading is the leading income source, but salaries/wages and service business incomes are growing.

However, more than seven out of every 10 have no concrete long-term financial plans and there has been a slight decline in Ugandans who aspire to build a house as an over-riding lifetime objective.

Trading is the leading income source, but salaries/wages and service business incomes are growing.

However, more than seven out of every 10 have no concrete long-term financial plans and there has been a slight decline in Ugandans who aspire to build a house as an over-riding lifetime objective.

The purchase of land, farming activities and running a business continue to be the predominant investment aspirations for Ugandans according to the 2023 FinScope survey while trading is the leading income source, but salaries/wages and service business incomes are growing.

However, more than seven out of every 10 have no concrete long-term financial plans and there has been a slight decline in Ugandans who aspire to build a house as an over-riding lifetime objective.

Although more Ugandans track their spending, most claim insufficient earnings to cover spending. Seven out of every 10 Ugandans were operating a personal budget deficit (needing more money than they are earning to cover their personal budget).

In addition, more Ugandans are relying on their family and friends, personal savings and borrowing to manage their budget deficits than was the case in 2018. Only 11% are satisfied with their financial situation while 60% of adult Ugandans are not confident in their financial plans for old age.

The Finscope survey is a collaboration between the Ministry of Finance, Planning and Economic Development, Bank of Uganda, Financial Sector Deepening Uganda (FSD Uganda) and aBi Finance Limited. FinScope is a demand-side study of access, uptake, usage and perceptions of financial services.

The 2023 survey had three main objectives: to track overall trends in financial inclusion to provide information on how the landscape of financial inclusion has changed since 2018, including benchmarking these trends with countries within the region; to provide insights that could be utilized both at policy and market levels to further deepen financial inclusion. Thirdly, the survey describes the financial service needs of the adult population (individuals 16 years or older).

Savings and credit cooperative organizations (SACCOs) and mobile money have registered the highest increases in adoption since 2018 with the proportion of Ugandans utilizing them more than doubling.

The proportion of Ugandans keeping their money at home has also more than doubled which could be a sign of lack of confidence in any form of financial service provider whether formal or informal. In spite of the increase in overall savings among Ugandans, little is done digitally. Only two out of every 10 Ugandans claim to have ever saved electronically.

The main drivers for lack of pension savings, is low levels of awareness and unemployment. Nevertheless more Ugandans are saving both formally and informally) now than the case in 2018. This is an increase of six percent, however most still save to cover living expenses. There has also been a shift towards productive investments like real estate development, business and agriculture.

Mobile phone ownership is highest amongst 25–50-year-olds, and internet access is highest amongst 18–40-year-olds. Formal financial inclusion has increased, driven by greater mobile money uptake. An increasingly youthful population poses challenges to reducing financial exclusion. Dependents have the highest proportion of excluded. Exclusion also skews to women, rural dwellers, the Eastern region and casual labourers.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Uganda-Tanzania announce date for second joint business forum

Uganda-Tanzania announce date for second joint business forum

Women social entrepreneurs offered chance to visit New York

Women social entrepreneurs offered chance to visit New York

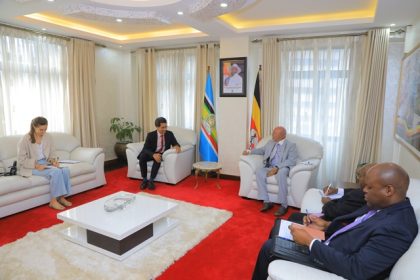

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Mastercard Community Pass showcases apps for underserved

Mastercard Community Pass showcases apps for underserved