IMF thinks oil impasse will slow Uganda’s growth prospects

Schimmelpfennig said the government’s medium-term fiscal policy framework rests on the assumptions that oil sector investments proceed as planned.

Schimmelpfennig said the government’s medium-term fiscal policy framework rests on the assumptions that oil sector investments proceed as planned.

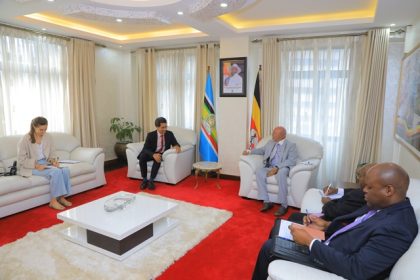

October 16—A recent visit by an International Monetary Fund (IMF) Mission to Uganda, under the Article IV provision, has suggested the government scale back its projected growth forecasts in light of the impasse with oil companies over payment of taxes.

This is delaying crucial Final Investment Decisions (FIDs) previously expected before the end of this year and the start of commercial development of Uganda’s recoverable oil deposits of about 1.5 billion barrels. Between $10 billion and $15 billion of new investment over the next 10 years is directly related to the FIDs.

The IMF team thinks the government needs to identify concrete measures to offset revenue shortfalls in this year’s budget to safeguard its fiscal targets and prevent domestic arrears.

Head of the visiting mission, Axel Schimmelpfennig said in a statement, ‘Growth could remain at around 6 percent in 2019/20, if oil investments are not significantly delayed. The current account deficit widened to 11 pc of GDP in 2018/19 largely due to investment-related imports. The Ugandan shilling has remained broadly stable.

“After last year’s strong performance in domestic revenue collection, execution of the current budget (fiscal year 2019/20) is challenging. Delays in the implementation of some revenue measures and shortfalls in non-tax revenues are likely to widen the overall fiscal deficit. The authorities need to adopt measures of around 1 percent of GDP to safeguard their budget targets and prevent a recurrence of domestic arrears’.

During September, UK-based Tullow Oil said finalization of a $900 million farm-down deal involving Total E&P and China National Offshore Oil Company (CNOOC) Uganda Limited had floundered over payment of capital gains tax and who should pay it.

At the time, Paul McDade, the Tullow Oil Chief Executive Officer said, “The termination of this transaction is a result of being unable to agree all aspects of the tax treatment of the transaction with the Government of Uganda which was a condition to completing the Sale and Purchase Agreements (SPAs).”

This lack of a breakthrough, in talks that have been on-going during the past two years, severely damped the enthusiasm of several local investors who had gambled on a successful outcome and borrowed heavily on that basis.

Schimmelpfennig said, ‘The government’s medium-term fiscal policy framework rests on the assumptions that oil sector investments proceed as planned, implementation of the domestic revenue mobilization strategy yields ½ percent of GDP in additional revenue collection per year, and the government achieves improvements in public investment management, in particular in project selection, planning, and execution, to ensure that infrastructure investment yields the envisaged growth dividend’.

However the IMF Mission was positive on the Bank of Uganda’s recent decision to lower the CBR by 100 basis points to 9 percent in light of, ‘…core inflation at 2.5 percent year-on-year in September and projected to stay below 5 percent over the next 12–18 months. The financial sector remains healthy based on the latest reported financial soundness indicators. The regulatory framework and Bank of Uganda’s strong supervision have been instrumental in this regard,’ Schimmelpfennig said.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Boeing’s record SAF purchase supports airlines decarbonisation efforts

Boeing’s record SAF purchase supports airlines decarbonisation efforts

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Rolls-Royce basks in expanding African footprint

Rolls-Royce basks in expanding African footprint

Africans must resist being bulldozed in energy transition timetable debate

Africans must resist being bulldozed in energy transition timetable debate

CSBAG roots for increased funding for renewable energy

CSBAG roots for increased funding for renewable energy