A 34 percent rally on the Uganda Securities Exchange has reshaped local wealth rankings, with MTN Uganda chair Charles Mbire emerging as the bourse’s richest investor in 2026. New data from Billionaires.Africa highlights how a handful of liquid stocks and concentrated ownership continue to drive wealth creation on Uganda’s small but influential capital market.

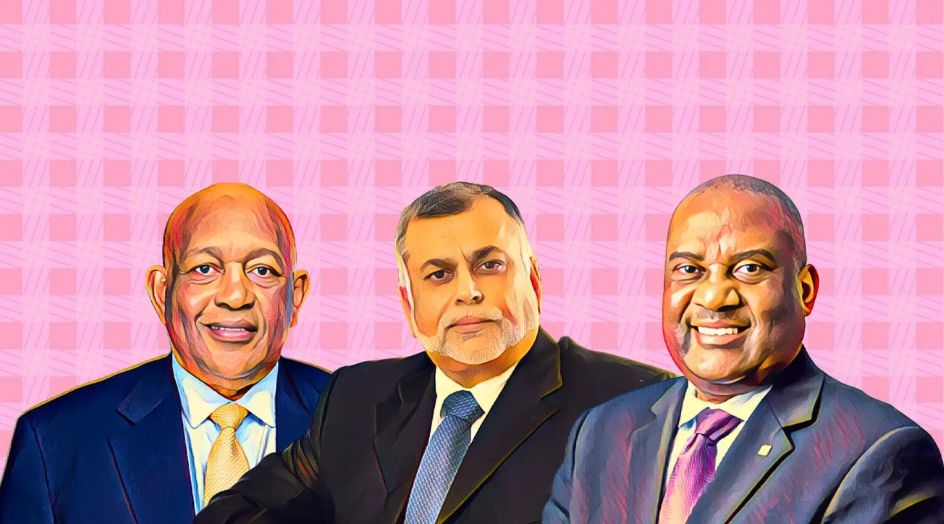

A sharp rally on the Uganda Securities Exchange has reshaped the local wealth league tables, pushing long-time telecoms investor Charles Mbire to the top of the bourse’s rich list in 2026. According to new rankings by Billionaires.Africa, Mbire is now the single largest investor on the USE, underscoring how price movements in a concentrated market can mint outsized fortunes.

The USE All Share Index climbed about 34 percent in the 12 months to February 4, 2026, lifting total market capitalisation to roughly UGX 37.3 trillion—a notable run for a market that remains small by global standards. As in previous cycles, the gains were driven largely by a handful of liquid counters and a tight circle of investors holding meaningful blocks of stock.

At the centre of the rally sits MTN Uganda, the USE’s most actively traded and closely watched stock. Mbire, who chairs the telecoms operator, holds an estimated 4 percent stake valued at about USD91.1 million, making him by far the richest investor on the exchange. His position reflects both MTN’s dominance as Uganda’s largest listed telecoms firm and the steady expansion of its business beyond voice into data, mobile money and digital services, which continue to attract institutional and retail interest.

The rankings also highlight the enduring influence of banking stocks on the USE. Veteran businessman Sudhir Ruparelia placed second with an estimated portfolio value of USD11.4 million, anchored by holdings in Stanbic Uganda Holdings and Bank of Baroda Uganda. Stanbic remains one of the exchange’s core dividend counters, while Bank of Baroda has carved out a stable niche serving corporate and retail clients, making both attractive to long-term investors.

Behind the top two, the list illustrates the scale gap that defines Uganda’s market. I. K. Kabanda, a long-standing shareholder in Stanbic Uganda Holdings, ranked third with a portfolio valued at about USD4 million, followed closely by Ceasor Mulenga, whose 1.82 percent stake in Bank of Baroda Uganda was worth an estimated USD3.8 million. Their positions show how even relatively modest percentage holdings can translate into significant wealth in a market with a limited free float.

Quality Chemical Industries stands out as the only non-bank, non-telecom counter producing multiple names on the list. Co-founders Frederick Kitaka, Emmanuel Katongole and George Baguma each ranked among the top ten, with individual stakes valued at roughly USD3.4 million. QCIL remains a rare example of a locally built pharmaceutical manufacturer on the public market, benefiting from long-term contracts and the strategic importance of domestic drug production.

The lower half of the ranking is dominated by Bank of Baroda Uganda shareholders, including Mbire Michael, Joseph Byamugisha and Muhimbise Andrew. Their presence reflects patient local capital that accumulates quietly over time and shows up clearly in ownership registers, even if it attracts little day-to-day trading attention.

Taken together, the Billionaires.Africa ranking offers a snapshot of a market where wealth creation is highly concentrated and closely tied to a few flagship companies. The 34 percent rally has lifted portfolios, but it has also reinforced a familiar reality. On the Uganda Securities Exchange, scale, liquidity and strategic positioning in a small number of stocks still matter far more than breadth, and the biggest winners remain those who were already firmly seated on the register before the rally began.

The Rankings

(1) Charles Mbire

Portfolio value: $91.1 million

Holdings: About 4.00% stake in MTN Uganda

Charles Mbire is the chairman of MTN Uganda and one of Uganda’s best-known dealmakers, with business interests that span telecoms, energy and finance. MTN Uganda is the country’s largest listed telecoms operator, selling mobile voice and data services and expanding into mobile money and other digital products.

(2) Sudhir Ruparelia

Portfolio value: $11.4 million

Holdings: 0.65% stake in Stanbic Uganda Holdings; 2.5% stake in Bank of Baroda Uganda

Sudhir Ruparelia is the founder of the Ruparelia Group and one of Uganda’s most prominent businessmen, best known for banking, property and hospitality. Stanbic Uganda Holdings is the listed holding company for Stanbic Bank Uganda, one of the country’s biggest lenders, while Bank of Baroda Uganda is the listed arm of the India-linked bank operating locally.

(3) I. K. Kabanda

Portfolio value: $4.0 million

Holdings: 0.42% stake in Stanbic Uganda Holdings

I. K. Kabanda is a long-standing shareholder on Stanbic Uganda’s register, a name that appears among the bank’s notable local holders. Stanbic Uganda Holdings is anchored by Stanbic Bank Uganda, a top-tier commercial bank and a key dividend counter on the exchange.

(4) Ceasor Mulenga

Portfolio value: $3.8 million

Holdings: 1.82% stake in Bank of Baroda Uganda

Ceasor Mulenga, often styled King Ceasor Augustus Mulenga in corporate references, is a Ugandan entrepreneur whose investments span business and philanthropy. Bank of Baroda Uganda is a listed commercial bank providing corporate and retail banking services in Uganda.

(5) Frederick Kitaka

Portfolio value: $3.4 million

Holdings: 2.79% stake in Quality Chemical Industries

Frederick Kitaka is a co-founder of Quality Chemical Industries and one of the executives associated with building the company’s financial and operational backbone. Quality Chemical Industries is a Ugandan pharmaceutical manufacturer, known for producing medicines locally through partnerships that helped put domestic drug manufacturing on the public market.

(6) Emmanuel Katongole

Portfolio value: $3.4 million

Holdings: 2.79% stake in Quality Chemical Industries

Emmanuel Katongole is a co-founder and chair figure at Quality Chemical Industries, widely linked to the company’s growth into Uganda’s most recognisable listed pharma manufacturer. The business focuses on producing essential medicines and supplying both public and private markets.

(7) George Baguma

Portfolio value: $3.4 million

Holdings: 2.79% stake in Quality Chemical Industries

George Baguma is a co-founder of Quality Chemical Industries and has been associated with the commercial side of the business as it scaled. Quality Chemical Industries manufactures pharmaceuticals in Uganda, a rare example in the region of a listed company built around local drug production.

(8) Mbire Michael

Portfolio value: $1.9 million

Holdings: 0.94% stake in Bank of Baroda Uganda

Mbire Michael is a notable shareholder in Bank of Baroda Uganda, with a stake large enough to place him among the bank’s bigger disclosed holders. Bank of Baroda Uganda is a listed lender offering retail and corporate banking services.

(9) Joseph Byamugisha

Portfolio value: $1.3 million

Holdings: 0.63% stake in Bank of Baroda Uganda

Joseph Byamugisha is a Bank of Baroda Uganda shareholder whose name appears among the bank’s disclosed blockholders. Bank of Baroda Uganda is a commercial bank listed on the USE, with earnings tied to traditional lending, fees and treasury activity.

(10) Muhimbise Andrew

Portfolio value: $1.2 million

Holdings: 0.60% stake in Bank of Baroda Uganda

Muhimbise Andrew is a significant shareholder in Bank of Baroda Uganda, representing the kind of patient local capital that still shows up clearly on USE registers. Bank of Baroda Uganda is a listed banking counter focused on deposits, lending and corporate banking relationships.

EgyptAir inducts first A350-900 into long-haul fleet

EgyptAir inducts first A350-900 into long-haul fleet

From Kampala to Dubai, Desert & Nile Artistry brings African heritage to the global stage

From Kampala to Dubai, Desert & Nile Artistry brings African heritage to the global stage

New Mombasa–Goma fibre link goes live, opening digital highway across East Africa

New Mombasa–Goma fibre link goes live, opening digital highway across East Africa

New monitoring methods could reshape how Africa safeguards bridges and pressure vessels

New monitoring methods could reshape how Africa safeguards bridges and pressure vessels

Why Experience Still Matters in Aviation — and why Girma Wake’s Uganda appointment is being misread

Why Experience Still Matters in Aviation — and why Girma Wake’s Uganda appointment is being misread

Uganda study shows how treating depression can strengthen HIV care

Uganda study shows how treating depression can strengthen HIV care