Uganda banks bullish about lending to agriculture as Stanbic sets pace

Stanbic Bank’s Ugandan unit accounted for nearly a quarter of industry credit to agriculture during 2021, signaling improving confidence in a sector that lenders have often cited as risky.

Uganda’s twenty-six tier one banks collectively lent UGX 2 trillion to agriculture during the year, with Stanbic accounting for UGX467 billion of that figure. Based on the industry loan book to November 2021, the two trillion accounted for just over 12percent of the UGX 16.5trillion total that had been given out up to that point.

That was equivalent to a fifty percent increase in advances to agriculture over a five-year period. The sector is also seeing better credit terms as lenders become more confident about its prospects.

“We have seen a big increase in private sector credit to the sector which has now overtaken the funds that are available under the Agricultural Credit Facility,” says Dr Adam Mugume, the director for research at the Bank of Uganda.

Set up in 2009 to boost support large scale farming and value addition to agricultural produce, the Agricultural Credit Facility (ACF) is a jointly managed concessional credit facility under which commercial banks match every shilling the government makes available for lending to agriculture. Borrowers access the funds at a concessional rate of 12pc.

Private sector credit to agriculture now accounts for about three-quarters of all lending to the sector, eclipsing funds provided under the ACF, which amounted to just about UGX 500 billion last year according to Mugume.

“I think the ACF debunked the notion that lending to agriculture was all too risky and banks are a lot more confident today. As a result, they have now gone beyond the ACF and large scale and midstream projects, to lend from their own resources to individual borrowers and groups such as cooperatives and Saccos who meet their risk profile,” Mugume added.

Such borrowers are given credit at prime rates which are higher than the ACFs’ 12percent but still lower than the regular commercial lending rates.

The agriculture sector also enjoyed better credit terms last year as Uganda’s lenders sought safe havens amidst the economic chaos occasioned by Covid-19 restrictions to economic activity.

According to the Bank of Uganda’s bank lending survey report for the second quarter of fiscal 2021/22, agriculture was one of only two sectors that continued to enjoy confidence among lenders owing to its continued resilience even in the face of the Covid-19 disruptions. That led to some easing in lending conditions to the sector and household personal loans while building, mortgage, real estate and mining saw tightening.

Building, mortgage, construction and real estate saw borrowing terms worsen by 47.8pc during the period on perception of heightened risk, while it became 17 and 21pc easier to borrow for agriculture and the personal and household segments respectively.

For instance, Stanbic dedicated 12.6 percent of its UGX 3.7 trillion loan book to agriculture. Lending went to individual farmers, cooperatives, large-scale plantation owners and farm suppliers who have ramped up storage and processing capacity. The sector ranked fourth behind personal and household loans, construction and real estate and trade in the lender’s loan book.

“Stanbic Bank plays a significant role in the agricultural production chain by helping to finance processes that ensure higher value is gained from the crops and animal products produced and consequently increasing Uganda’s export earnings. We continue to support the expansion of grain storage and processing facilities for key industry players in the formal grain trade,” said the bank’s head of communication Mr. Kenneth Agutamba.

Employing close to seventy percent of the population and accounting for a quarter of GDP and three quarters of export earnings, lending to agriculture has for years been at the centre of discussions between government and Uganda’s 26 commercial banks.

The government is banking on value addition in the sector to spur industrialization and job creation. It set up the ACF to provide medium and long-term financing options to projects in agriculture and agro-processing, focusing mainly on commercialization and value-addition.

The interventions have triggered demand for cereals, in turn creating demand for credit by primary producers who are now funded through a variety of initiatives by commercial lenders.

“I think the sector is now running largely under its own momentum given the high appetite for credit and the lenders willingness to extend loans even outside the safety net of the ACF,” says Mugume.

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

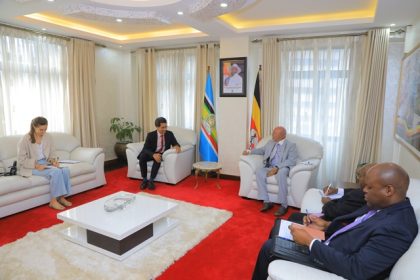

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Uganda urged to pitch for organic produce during NAM Summit

Uganda urged to pitch for organic produce during NAM Summit

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

Nile Breweries launches UGX 4Bn barley processing facility in Kween district

Nile Breweries launches UGX 4Bn barley processing facility in Kween district