Tanzania replaces Uganda as top maize supplier to Rwanda

The amount of maize grain traded in the East African region between October and December 2019 (fourth quarter of 2019) was around 457,000 tonnes, which was more than double the previous quarter, the fourth quarter of 2018, and recent five-year average respectively.

The amount of maize grain traded in the East African region between October and December 2019 (fourth quarter of 2019) was around 457,000 tonnes, which was more than double the previous quarter, the fourth quarter of 2018, and recent five-year average respectively.

Tanzania has emerged as the leading supplier of maize to Rwanda on the back of a surge in its trade of the commodity with Uganda. Business sources say Mutukula, the border town at the Uganda and Tanzania frontier has become a major market for Ugandan maize as Rwanda increasingly looks east to ease shortages that had led to a spike in prices of the commodity.

Maize is the leading regional staple and makes up nearly half of all traded commodities across borders. The pickup in purchases by Tanzania has supported farm gate prices for maize which have bounced back to UGX 800 in key productions zones in central Uganda, sources say.

The Market Analysis Sub-group of the Food Security and Nutrition Working Group (FSNWG) says in its January 2020 bulletin that Rwanda is steadily closing the deficit and forcing prices to fall back again after realigning its supply chain. Prices peaked at close to $500 per tonne in December compared to just under $300 2019 in February.

FSNWG monitors informal cross-border trade of 88 food commodities and livestock in eastern Africa in order to quantify the impact on regional food security. The bulletin summarizes informal trade across selected borders of Tanzania, Burundi, Rwanda, Uganda, Kenya, Somalia, Djibouti, Ethiopia, Sudan, and South Sudan and DRC. Data is provided by the Eastern Africa Grain Council (EAGC), the Famine Early Warning Systems Network (FEWS NET), the Food and Agricultural Organization of the United Nations (FAO), the National Bank of Rwanda (NBR) and the World Food Program (WFP).

Prices increased rapidly in Rwanda due to reduced inflows from Uganda while supply chain and market linkages with Tanzania continued to develop amidst high demand. By December 2019, Uganda recorded the lowest average price for a tonne of maize at $320. In Ethiopia, it was $330 per tonne; Kenya at $400; Tanzania at $370, but in Burundi it soared to $650 per tonne.

The amount of maize grain traded in the East African region between October and December 2019 (fourth quarter of 2019) was around 457,000 tonnes, which was more than double the previous quarter, the fourth quarter of 2018, and recent five-year average respectively.

Exports from Tanzania and Uganda represented 85 pc and 14 pc of the total regional trade respectively. Rwanda, Kenya and South Sudan accounted for 77 pc, 12 pc and six percent of the total regional imports respectively.

Exceptionally high imports of maize from Tanzania by Rwanda was as result of the concerted efforts by the government and private sectors; and humanitarian organizations to find replacement for imports from Uganda following trade-restricting border closures in February 2019. Prices of maize grain, flour and animal feeds had been rising across most markets in Rwanda due to acute shortage of maize grain from Uganda.

It took quite some time for significant stocks to be acquired and transported to Rwanda, which partly happened in the fourth quarter of 2019. Maize exports to Kenya declined seasonably, because of increasing domestic supplies from the October-to-December harvest, in addition to delayed entry into the market of Uganda’s December harvest following extended rains that delayed preparations of the maize grain for the market.

Meanwhile, Uganda’s maize exports to South Sudan were above average as sustained low level of conflict, expansion of market functions and trade routes attracted more supplies from Uganda, and the exports were accentuated by stoppage of supplies to Rwanda.

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

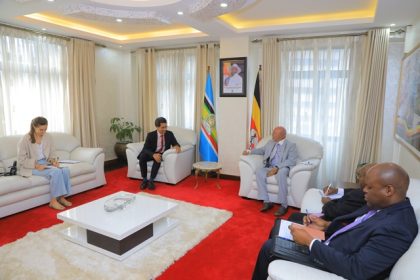

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Uganda urged to pitch for organic produce during NAM Summit

Uganda urged to pitch for organic produce during NAM Summit

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

Nile Breweries launches UGX 4Bn barley processing facility in Kween district

Nile Breweries launches UGX 4Bn barley processing facility in Kween district