PwC says government running out of room over rising debt

PwC suggests ways have to be found quickly to raise the local cover to repay loans in US dollars for new infrastructure.

PwC suggests ways have to be found quickly to raise the local cover to repay loans in US dollars for new infrastructure.

PwC Uganda, part of the international financial services consultancy group, has expressed concerns about Uganda’s rising debt situation in its 2019 outlook. Current total debt-to-GDP is hovering at 40 pc or just over $10 billion.

“Whereas we in PwC share the government’s optimism about the positive economic outlook, we are concerned about the deterioration of the public debt situation,’ states the report in part.

According to PwC, who provide advice to a host of leading companies and private investors, the major risks to the outlook of external debt sustainability relate to poor performance of domestic revenue, low revenues from exports as well as an increased rate of debt accumulation, particularly on non-concessional terms.

The report goes on to say while Uganda’s current debt burden is still rated as moderate risk of debt distress, the fact that the rating has deteriorated from ‘low risk’ to ‘moderate risk’ means that the country now has limited room for more borrowing before hitting the ‘high risk of debt distress’ rating.

PwC Uganda thinks any future public infrastructure and other investment projects will need rigorous assessment and prioritization if this limited space is to be used effectively to support growth. Increasing space for public investment will require efforts to boost public savings, as well as increasing domestic revenue mobilization.

The consultants also touched on rising poverty across the country. PwC Uganda says this increase in the poverty levels could be the evidence to confirm that the surge in infrastructure expenditure has had the un-intended consequence of denying appropriate funds to other key sectors of the economy that are critical to poverty reduction, such as health and education.

The situation is made worse by the amount of public resources wasted on inadequately designed, underfunded, long-delayed, and poorly implemented public infrastructure projects. This does not only deny the public from benefiting from the expected infrastructure projects, but they also undermine the growth of the economy, thereby affecting the country’s ability to repay the money borrowed to fund these projects.

It is therefore important that the infrastructure investment in Uganda, financed largely by external borrowing, is monitored very carefully to ensure that revenue streams (generated in local currencies) are strong enough to meet the debt obligations (payable in US dollars) when they fall due.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

Uganda-Tanzania announce date for second joint business forum

Uganda-Tanzania announce date for second joint business forum

Women social entrepreneurs offered chance to visit New York

Women social entrepreneurs offered chance to visit New York

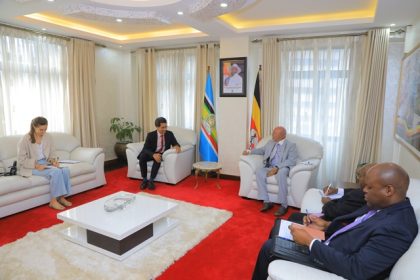

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Mastercard Community Pass showcases apps for underserved

Mastercard Community Pass showcases apps for underserved