Fitch raises Uganda’s credit rating from negative to stable

Rising inflation and tighter financing conditions pose risks to the near-term growth outlook for Uganda and this could slow the pace of the fiscal adjustment, however Fitch expects increasing investment into the hydrocarbon sector to support robust growth over the medium term.

Rising inflation and tighter financing conditions pose risks to the near-term growth outlook for Uganda and this could slow the pace of the fiscal adjustment, however Fitch expects increasing investment into the hydrocarbon sector to support robust growth over the medium term.

Fitch Ratings, the international credit agency, has revised the Outlook on Uganda’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to Stable from Negative and affirmed the IDR at ‘B+’. IDRs provide an ordinal ranking of issuers based on the agency’s view of their relative vulnerability to default, rather than a prediction of a specific percentage likelihood of default.

In Fitch’s view: ‘The revision of the Outlook reflects Fitch’s expectation that sustained recovery in real GDP growth and fiscal deficit reduction will lead to a broad stabilisation of the government debt to GDP ratio. While rising inflation and tighter financing conditions pose risks to the near-term growth outlook and this could slow the pace of the fiscal adjustment, we expect increasing investment into the hydrocarbon sector to support robust growth over the medium term’.

In February 2022, the authorities reached the final investment decision (FID) on plans for upstream oil production as well as for the East Africa Crude Oil Pipeline. The current timeline expects first oil in 2025, which means that neither oil production nor expected oil revenue has an impact on the forecast period. However, the associated infrastructure build-out will contribute to growth in 2023 and 2024. Fitch expects medium-term growth of between 6% and 7%; although we note that there has likely been some Covid-19 scarring in the form of shuttered businesses, skills erosion and workers exiting the labour market.

Fitch forecasts Uganda’s general government deficit to narrow to 7.5% of GDP in the fiscal year ending June 2022 (FY22), from 9.2% in FY21. This was the result of lower Covid-19-related spending, as well as lower capital expenditure, which we forecast to fall to 8.4% of GDP, from 10.1% in FY21. Revenue performance worsened slightly in FY22, owing to lower grant funding, but tax administration reforms have improved tax performance. Tax revenue increased to 12.4% of GDP after averaging just above 11% over the previous 10 years.

According to Fitch, ‘We expect overall revenue performance to remain above 14% in the forecast period, but the lack of new revenue measures in the FY23 budget will limit further improvement. We forecast the fiscal deficit to narrow to 6.7% of GDP in FY23.’

Uganda is under a $1 billion IMF Extended Credit Facility and successfully completed the first programme review in March 2022. The programme currently envisages further deficit reduction, to 4.7% of GDP in FY23, but the government’s FY23 budget, presented on June 14, contains a slightly higher fiscal deficit. A failure to come to agreement with the IMF on updated fiscal targets could delay future programme reviews and delay the disbursement of associated financing.

In FY23, we estimate the government will face external amortisation and interest costs of $840 million (1.8% of GDP). The IMF programme will disburse $250 million plus make available an additional $130 million in multilateral lending. We expect the balance of external debt servicing costs to be met with external commercial borrowing. The government will meet its deficit financing needs through a combination of external project lending and domestic debt issuance.

Fitch forecasts real GDP growth of 4.8% in calendar year 2022, down from 6% in 2021; this reflects a deceleration of growth following the strong post-Covid-19 recovery of 2021, as well as downside risks from global growth, supply shocks and tighter financing conditions. We forecast real GDP growth to remain robust at 6.4% in 2023, broadly in line with Uganda’s pre-Covid-19 growth levels and above the current ‘B’ median of 3.8%.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

Uganda-Tanzania announce date for second joint business forum

Uganda-Tanzania announce date for second joint business forum

Women social entrepreneurs offered chance to visit New York

Women social entrepreneurs offered chance to visit New York

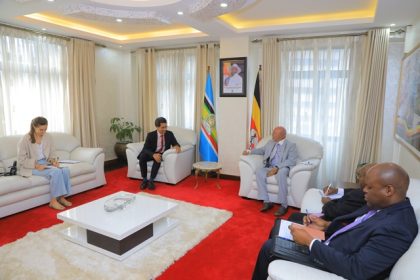

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Mastercard Community Pass showcases apps for underserved

Mastercard Community Pass showcases apps for underserved