CSBAG blows whistle on spiraling cost of domestic borrowing

Uganda should lean more towards external borrowing to mitigate the rapidly rising cost of debt and to free more resources for lending to the private sector, says Uganda civil society budget watchdog CSBAG.

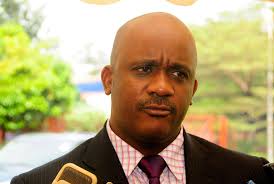

Presenting a position paper at a pre-budget dialogue on the Budget Framework Paper for fiscal 2022/23, and the economic recovery agenda this week, CSBAG executive director Julius Mukunda observed that the cost of servicing domestic debt was taking more resources compared to its share of national debt stock. The treasury projects to spend roughly 75pc -UGX 4.05 trillion- on domestic interest payment compared to only UGX1.03 trillion on interest on external debt. This is despite domestic debt accounting for only 37pc of Uganda total debt stock which stood at UGX 69.5 trillion at the end of June 2021, Mukunda revealed.

“We are spending more on interest on the domestic debt portfolio which has a smaller share of total debt stock.The key drivers of this discrepancy are the shorter maturity and higher interest rates associated with domestic borrowing, compared to external borrowing,” Mukunda told 256BN.

External loans are longer tenure with longer grace periods and come with single-digit interest rates compared to domestic bonds which a typically short term with double-digit interest rates.

Private sector credit fell from 11.7pc during fiscal 2019/20 to 8.1pc in fiscal 2020/21, partly because of the government’s competition for domestic credit, Mukunda said. This despite a sharp fall in lending rates from 19.3pc in 2019/20 to 11.7 last year.

“The major reason for the fall in lending to the private sector is that lenders found lending to government be more attractive, with less risk,” Mukunda said.

Debt is also rising fast, expanding by 27.4pc in the year to June 30, 2021. Treasury is projecting to UGX 6.86trillion externally and UGX2.83trillion, next financial year. Total debt repayment including domestic financing, interest payment and amortization will suck UGX15.20 trillion out of the resource envelope for the year. Domestic revenues are projected at UGX 25.5 trillion.

CSBAG is advocating for more budget than project support from development partners because the latter category gives the government more flexibility on where to direct the mobilized resources. The collective also decried the reduction in funding going to local governments from UGX4.570 trillion last year, to 4.227 trillion in the financial year that starts on July 1, 2022. This is despite an increase in administrative units to 10 cities, 135 districts and 41 municipalities.

CSBAG also notes that the wage and nonwage components of funding to local governments remain unchanged despite a staffing gap of 40pc of the approved structure. Also, 83pc of the local government budge is for recurrent expenditure, while only 17pc is allocated to development. Chronic underfunding has affected the ability of local governments to function effectively in service delivery CSBAG says.

“We are keen on local government financing because these are the people at the frontlines of service delivery and it is important to know how these structures are financed and how that enables them to deliver services to the people,” Mukunda said.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

Unpacking results-based financing: balancing strengths with weaknesses

Unpacking results-based financing: balancing strengths with weaknesses

Women social entrepreneurs offered chance to visit New York

Women social entrepreneurs offered chance to visit New York

Why and how economics must change

Why and how economics must change

Stanbic Bank Uganda Chief Executive elevated to regional role in Nairobi

Stanbic Bank Uganda Chief Executive elevated to regional role in Nairobi