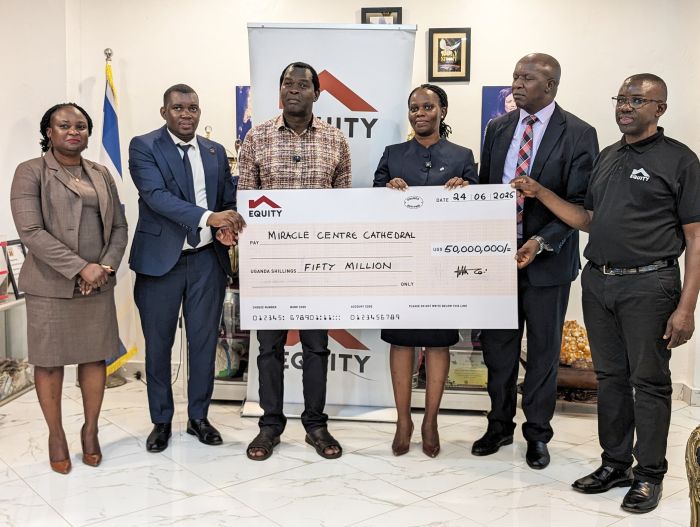

Equity Bank Uganda has today reaffirmed its commitment to faith-based development initiatives with a UGX 50 million donation to support an upcoming three-day crusade hosted by Miracle Centre Ministries and renowned global evangelist, Pastor Benny Hinn.

The cheque was officially handed over on June 24, by Ms. Catherine Psomgen, Equity Bank Uganda’s Director for Public Sector and Social Investments, to Pastor Robert Kayanja at Miracle Centre Cathedral in Rubaga. The highly anticipated crusade is expected to draw thousands of worshippers and spiritual leaders from across the region, offering a moment of revival, hope, and healing.

“This partnership reflects Equity Bank’s mission to transform lives and restore dignity in communities that are often underserved,” said Ms. Psomgen during the handover. “We are proud to stand alongside Pastor Kayanja Ministries not only in faith, but in practical work that uplifts people and drives socio-economic change.”

This is not the first collaboration between the bank and the ministry. In 2023, Equity Bank and Kayanja Ministries launched a transformational agriculture initiative in Karamoja — one of Uganda’s most vulnerable regions — aiming to improve food security and empower local communities through modern farming techniques.

Pastor Robert Kayanja welcomed the support as a timely boost for the ministry’s growing outreach. “We thank Equity Bank for standing with us. This crusade with Pastor Benny Hinn is more than an event — it’s a spiritual and social awakening. We look forward to what God will do in these three days, and we are grateful for partners who believe in both the Word and the work.”

The partnership also reflects Equity Bank’s Africa Recovery and Resilience Plan (ARRP), which targets holistic community support through strategic investments in key sectors such as agriculture. Notably, agriculture already accounts for 30% of the bank’s total lending portfolio — a signal of its long-term commitment to food systems, rural economies, and inclusive growth.

Government reaffirms commitment to capitalise UDB as Bank deepens development finance role

Government reaffirms commitment to capitalise UDB as Bank deepens development finance role

Uganda’s DEI Biopharma gene therapy breakthrough could transform sickle cell treatment

Uganda’s DEI Biopharma gene therapy breakthrough could transform sickle cell treatment

Equity Bank Uganda set to close 2025 on firmer footing as clean-up phase gives way to growth

Equity Bank Uganda set to close 2025 on firmer footing as clean-up phase gives way to growth

Stanbic targets wider access to affordable financing with ‘Oli In Charge’ campaign

Stanbic targets wider access to affordable financing with ‘Oli In Charge’ campaign

USA–Canada certification dispute could expose Uganda and regional airlines to regulatory risk

USA–Canada certification dispute could expose Uganda and regional airlines to regulatory risk

Sumsub launches AI Agent Verification as Africa grapples with surge in AI-driven fraud

Sumsub launches AI Agent Verification as Africa grapples with surge in AI-driven fraud