CSBAG urges fiscal discipline as S&P upgrades Uganda’s economic outlook to “Positive”

Economy watchdog Civil Society Budget Advocacy Group (CSBAG), has welcomed S&P Global Ratings’ revision of Uganda’s economic outlook from “Stable” to “Positive”, describing it as a signal of renewed investor confidence in the country’s economic resilience. However, the group cautioned that rising domestic debt, persistent supplementary budgets, and weak revenue collection could undermine long-term fiscal stability and inclusive growth.

The upgrade, announced by S&P on November 7, 2025, affirms Uganda’s ‘B-/B’ sovereign credit rating and recognises key strengths, including resilient growth, a narrowing trade deficit, record foreign exchange reserves, and the recovery of concessional financing from development partners such as the World Bank, which recently approved USD 2 billion (UGX 7.5 trillion) in new project lending.

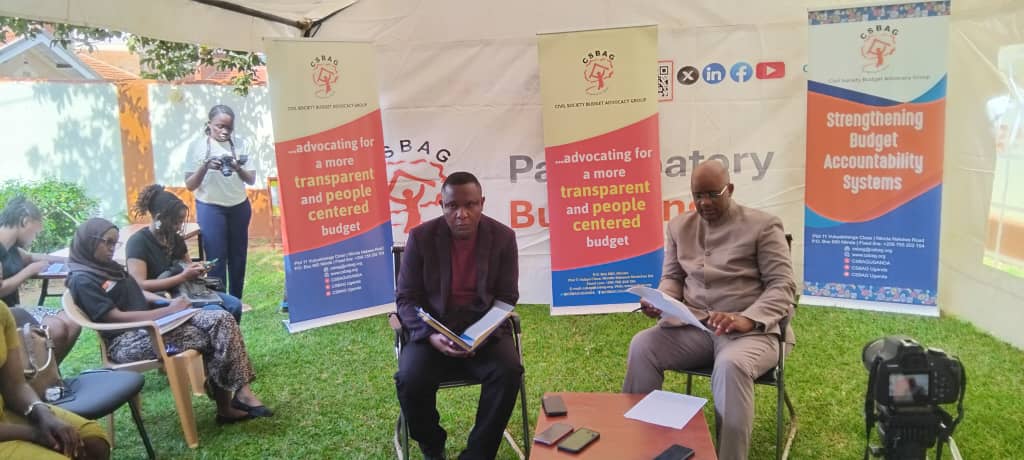

CSBAG executive director Julius Mukunda, speaking at a press briefing on November 12, 2025, noted that Uganda’s economy expanded by 6.3pc in FY2025 and is projected to average 6.4pc through FY2028, driven by investment in agriculture, construction, and manufacturing. The group also cited the progress of the Tilenga, Kingfisher, and EACOP oil projects as potential game changers for Uganda’s export capacity and fiscal outlook once production begins in 2026.

Uganda’s foreign exchange reserves rose to a record USD 5.4 billion in September 2025, providing a buffer equivalent to 2.5 months of import cover, while inflation eased to 3.4pc, below the Bank of Uganda’s 5pc target. The shilling appreciated by 5.2pc between January and October 2025, supported by strong export earnings and remittance inflows.

Despite these gains, CSBAG warned that Uganda’s domestic debt burden—now at UGX 60 trillion and constituting half of total public debt, is crowding out private sector lending and eroding fiscal space. Interest payments reached UGX 7 trillion in FY2025, consuming nearly a quarter of tax revenues.

“Every shilling spent on interest is a shilling taken from classrooms, hospitals, and farmers,” Mukunda said, urging government to shift borrowing toward concessional sources and to reduce reliance on costly domestic debt.

The group also criticised the government’s continued use of supplementary budgets—three of them in FY2024/25 totalling UGX 5.7 trillion (2.5pc of GDP)—arguing that such practices erode fiscal credibility and transparency. Uganda’s fiscal deficit, currently at 6pc of GDP, is projected to widen further ahead of the 2026 elections, against a target of 3pc under the Charter of Fiscal Responsibility.

CSBAG further pointed to Uganda’s low tax-to-GDP ratio of 14pc, well below regional peers, as a constraint on development spending. The CSO called for accelerated implementation of the Domestic Revenue Mobilisation Strategy (DRMS) to close tax loopholes and phase out unnecessary exemptions.

While welcoming the stable banking sector and renewed external financing, CSBAG said the benefits of Uganda’s improving trade balance—driven by record coffee and gold exports—remain unevenly distributed, with smallholder farmers and local communities capturing only a fraction of export value.

“The S&P outlook is a vote of confidence in Uganda’s potential, not a clean bill of fiscal health,” CSBAG emphasized. It urged government to enforce fiscal discipline, protect social spending, and manage oil revenues transparently through the Petroleum Fund to ensure equitable and sustainable growth.

“Uganda’s economy is ready for take-off but its institutions must be strengthened to land the plane safely,” Mukunda concluded.

Equity Bank Uganda set to close 2025 on firmer footing as clean-up phase gives way to growth

Equity Bank Uganda set to close 2025 on firmer footing as clean-up phase gives way to growth

Stanbic targets wider access to affordable financing with ‘Oli In Charge’ campaign

Stanbic targets wider access to affordable financing with ‘Oli In Charge’ campaign

USA–Canada certification dispute could expose Uganda and regional airlines to regulatory risk

USA–Canada certification dispute could expose Uganda and regional airlines to regulatory risk

Sumsub launches AI Agent Verification as Africa grapples with surge in AI-driven fraud

Sumsub launches AI Agent Verification as Africa grapples with surge in AI-driven fraud

The hidden cost of blocked airline funds

The hidden cost of blocked airline funds

KPMG flags widening execution gap as tech leaders bet on AI maturity, talent and partnerships

KPMG flags widening execution gap as tech leaders bet on AI maturity, talent and partnerships