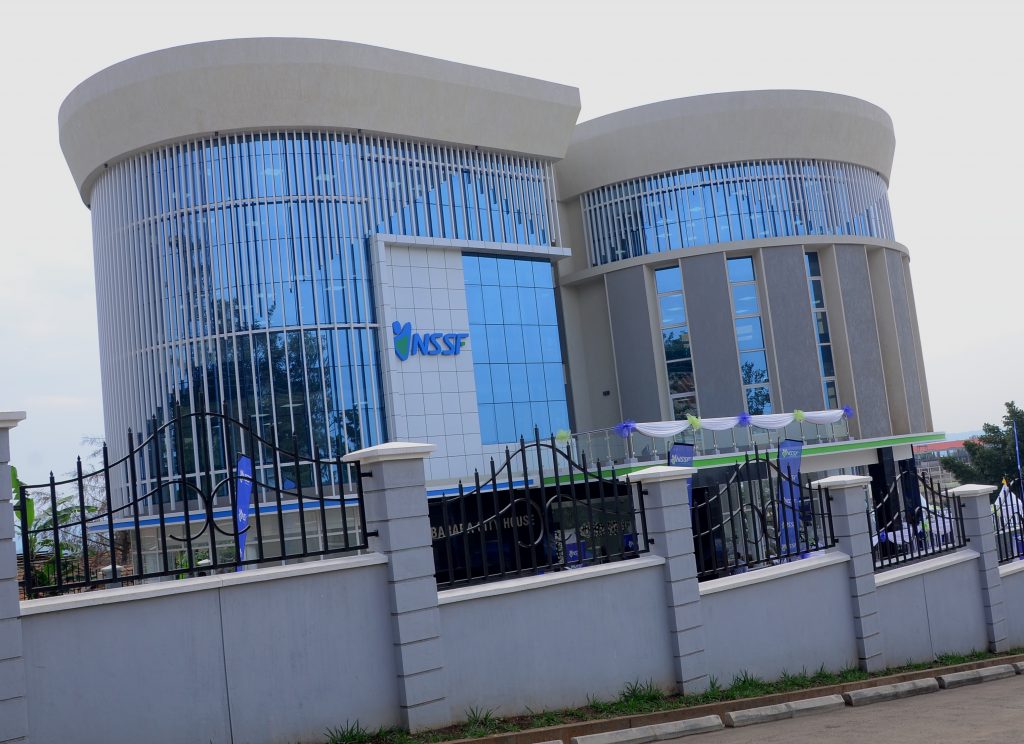

$2.7 billion social security fund unveils new office block

The office complex is valued at UGX3.9 billion (about $1 million), with a total built-up area of approximately 1,500 square metres and parking capacity for up to 40 vehicles.

The office complex is valued at UGX3.9 billion (about $1 million), with a total built-up area of approximately 1,500 square metres and parking capacity for up to 40 vehicles.

July 1— The National Social Security Fund (NSSF) has disclosed that of its $2.7 billion in total assets, fixed income investments take up 79 pc while equity and real estate follow at 15 pc and 6 percent respectively as it unveiled its latest commercial complex in Mbarara, western Uganda recently.

The mandatory contribution scheme currently has just over a million active members, mostly employees in the formal sector of the economy. However NSSF last year began a campaign targeting voluntary members to save with the Fund.

Richard Byarugaba, NSSF managing director said at the official opening, “Mbarara City House is a milestone for the Fund, because it is yet another step towards the realization of our real estate strategy, focused on creating value for our members through constructing commercial buildings and housing estates in major towns of Uganda. Projects such as these enable us give our members a reasonable and consistent return, while preserving their savings, paying them an annual return which is 2 percent above the ten-year inflation.”

Mbarara is just over 200 kilometres southwest of Kampala and the new commercial development follows one opened by the Fund in Jinja town in eastern Uganda over a year ago. NSSF wants to increase returns for members’ retirement benefits by investing in the real estate sector as a way of hedging against inflation. The real estate sector has been allocated a long term strategic asset allocation of 15 pc to 25 pc.

The modern complex, valued at UGX3.9 billion (about $1 million), with a total built-up area of approximately 1,500 square metres and parking capacity of up to 40 vehicles, is the Fund’s second real estate development outside Kampala. Officials say rental rates will be affordably priced to help provide modern commercial real estate space for potential tenants.

The State Minister for Housing, Chris Baryomunsi said, “Projects such as these contribute to infrastructural development within the country and also support the national development agenda. With such investments, NSSF earns more money which makes it possible for the Fund to continue giving good value to members and improving lives as we work towards meeting the Millennium Development Goals.”

Byarugaba said, “Real estate allocation is currently at 14 pc and re-balancing of the Fund’s Investment Portfolio to the stipulated guidelines of 15 pc to 25 pc is being undertaken within a 5-year period. Ultimately, this calls for growth in the real estate allocation through permissible investments in income generating commercial and residential properties located in major Ugandan cities or major towns.”

Upturn in Kampala’s residential housing sector as economy recovers

Upturn in Kampala’s residential housing sector as economy recovers

Uganda’s proposed tax changes may dampen investor confidence

Uganda’s proposed tax changes may dampen investor confidence

Kampala metropolitan real estate market recovers from lows after pandemic

Kampala metropolitan real estate market recovers from lows after pandemic

Stanbic Bank introduces insurance package to protect schools from risks

Stanbic Bank introduces insurance package to protect schools from risks

Emerging oil industry helps to revive Kampala high-end residential market

Emerging oil industry helps to revive Kampala high-end residential market

Stanbic subsidiaries in tripartite pact with National Housing company to develop real estate

Stanbic subsidiaries in tripartite pact with National Housing company to develop real estate